Politicon.co

Economic challenges Azerbaijan and Georgia face: Summary of post-war markets

Since the disintegration of the Soviet Union, post-Soviet countries have failed to decrease their economic dependence on Russia. When the war in Ukraine triggered the economic downturn, endangering food and energy security for most countries, the South Caucasus was no exception. Elevated inflation and consumer prices caused by supply-demand imbalances and rising commodity prices hit those economies eventually.

Even before the war, it’s no surprise that Russia was already using its economic leverage against countries with fragile economies, especially to impose its political agenda. Taking the main macroeconomic indicators of one emerging neighborhood economy, Russia has the power to change the rules according to its strategic alignment. As one of the weakest economic regions of post-Soviet space, South Caucasus remained under this hegemony for a long time, and all efforts to put end to this subjection were carefully undermined by Russia.

The first step to presume the Russian domination even after the separation from the Soviet system was preventing the diversification of economies. After 30 years of independence, Azerbaijan and

However, in Azerbaijan, reliance on Russian foods and services was not questioned seriously up until Russia’s invasion of Ukraine, while in Georgia, some questions aroused after the 2008 war, but starting from 2012 all of them were ignored. As a result of this, one can abruptly observe the imbalance in the trade relations between these countries.

Looking at Georgian trading partners by exports, Russia was among the top three in January-July 2022, accounting for 10.9% of the total exports, following China (15.3%) and Azerbaijan (11.3%). Respectively, for the same time duration, the share of imports from Russia was the second biggest (12%), following Turkey (17%).

These indicators were slightly different for Azerbaijan, whereas Russian shares among the overall exports leveled at 4.3% for the given time period. At the same time, Russia accounted for 18.69% of all imports during the first seven months of 2022. Consequently, Russia has remained the first trading partner by imports, followed by Turkey (16%) and China (15%).

As for the volatile nature of economic relations with Russia, both Azerbaijan and Georgia need to diversify their supply chains, increase the overall production of daily goods and use business-friendly tax rates.

Trade balance

Despite the fact neither Azerbaijan nor Georgia is a direct party to the sanctions against Russia, indirect effects could be seen on both economies. Especially, looking at the real-time payments, there were in getting payments from Russian customers for the exports.

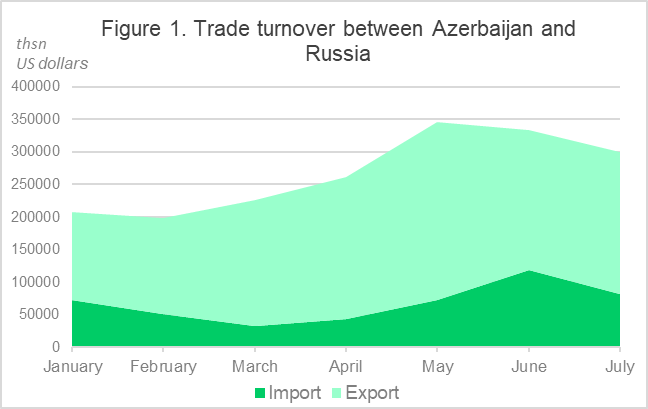

Data source: Azerbaijan State Customs Committee

In January-July 2022, Russia accounted for 6.2% of Azerbaijan's total foreign trade turnover. 74.8% of the total trade volume with Russia is imported, and the remaining 25.2% is export products. Compared to the same period in 2021, the volume

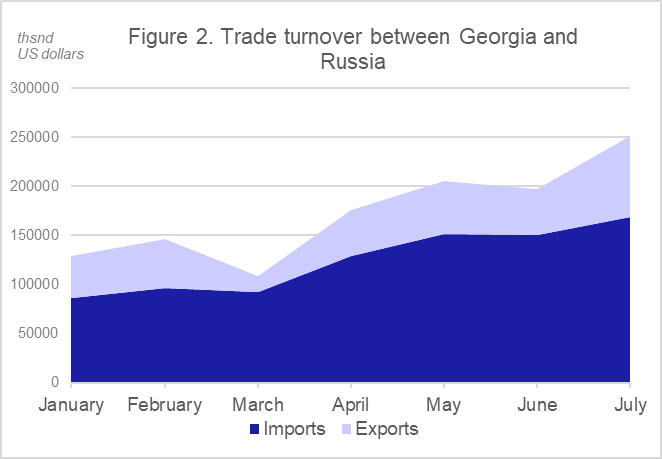

Data source: GeoStat

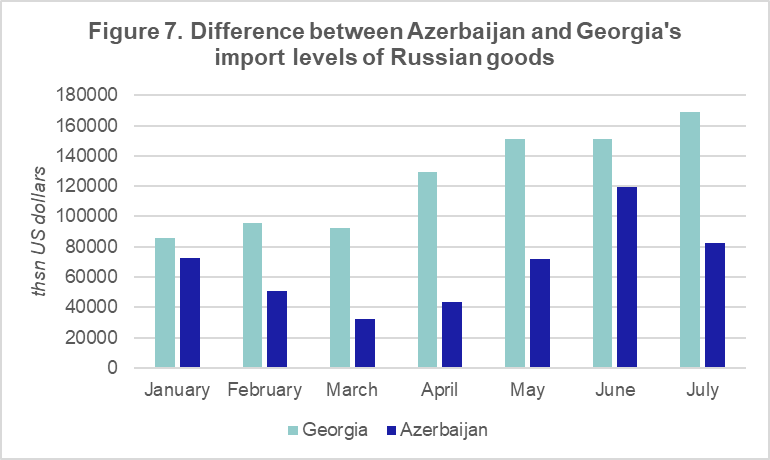

On the other hand, in Georgia, despite the considerably extended supply chain operations with other countries, the share of trade with Russia in the total trade balance of Georgia remained unchanged in comparison with the same term of last year, at 12%.

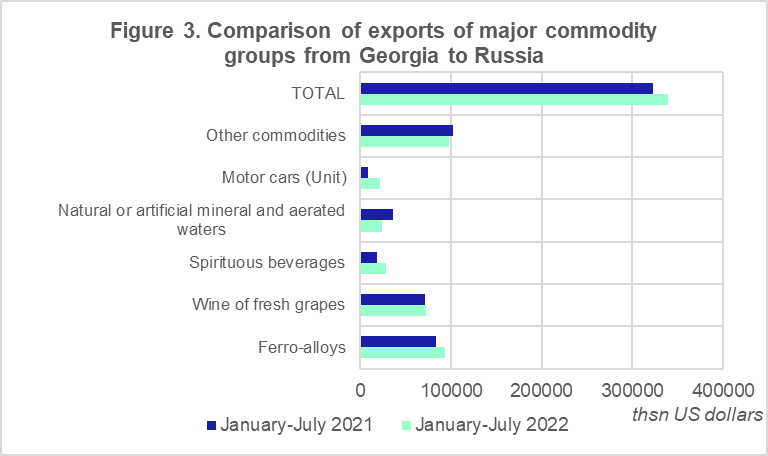

Exports

During the first seven months of 2022, exports of Georgian products to Russia increased by 5% and amounted to USD 339 million, while the imports soared b

Additionally, for Georgia, sanctions did not cause a major reduction in exports to Russia as expected, on the contrary, the share of wine, spiritous beverages and ferroalloys exports saw growth during the first seven months of 2022.

Looking at the details, during the first seven months of 2022, the value of exported motor cars doubled, showing the most increase among all other exports. Furthermore, demand for spirituous beverages rose by 57% during the mentioned timeline, reaching USD 28 million.

Data source: GeoStat

Russia accounted for 68% of total Georgian wine exports from January to July 2022, worth USD 72 million. Due to the heavy dependence on the Russian market, Georgian wine was feared to face a decline in exports. Compared to the previous year, Russian shares in the wine market increased after the unavailability of the Ukrainian market following the outbreak of war.

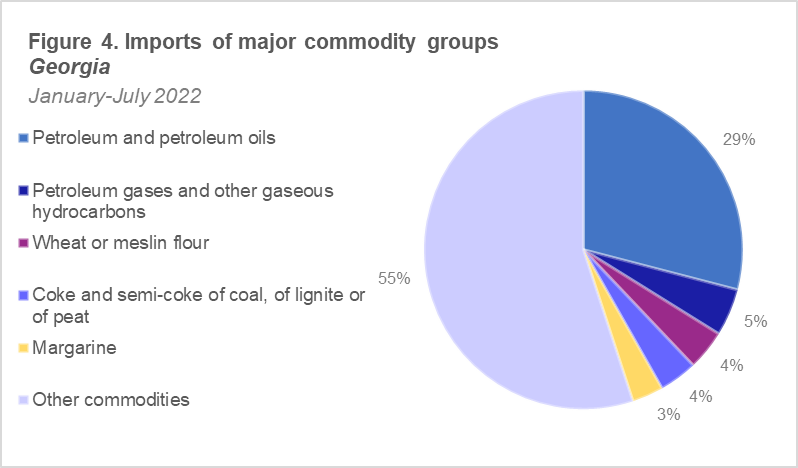

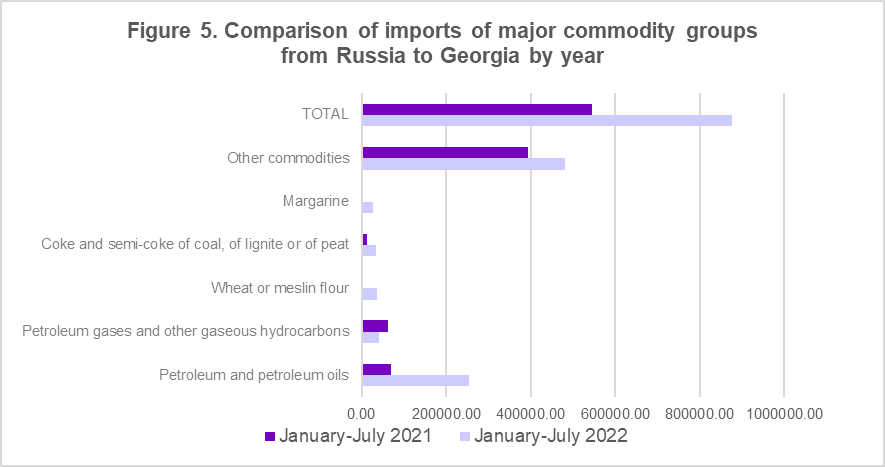

As for the share of imports, the overall cost of petroleum products outnumbered other products and peaked at USD 254 million. This value is 4 times more than the same period of the previous year. Following that, Georgia spent USD 42 million on natural gas from Russia in 2022, only a third of last year’s indicators.

Among all these, the largest growth was observed in wheat or meslin flour imports. Georgia has been dependent on Russian wheat and wheat flour traditionally. Therefore, numbers were not so promising in 2022 either. Thus, the value of imported Russian wheat or meslin flour leapt

Data source: GeoStat

Since high taxes were imposed by the Russian government on wheat in 2021, considering the undergoing risk, most importers replaced wheat by flour. Money spent on wheat and meslin itself in the first seven months of 2022 almost halved, compared to the same period of 2021, costing only USD 19 million, as opposed to USD 46.3 million.

Data source: GeoStat

To conclude, Georgian export market remained dependent on Russia during the first seven months of 2022, w

On the other hand, scanning Azerbaijan's export data, one can observe a steady growth from the beginning of the year until May, when export levels plunged. Especially after the commencement of the war in February, the trend climbed significantly, but after May it did not recover.

With respect to the major exported commodity groups, edible fruits and nuts, as well as citrus fruit peels and melon rinds were the most imported products by Russia in the first quarter of 2022, leveling at USD 48 million. Following that, vegetables and other edible legumes worth USD 42 million were among the most purchased products by Russia. In general, exports of non-oil products accounted for 98% of all exports to Russia during January-March 2022.

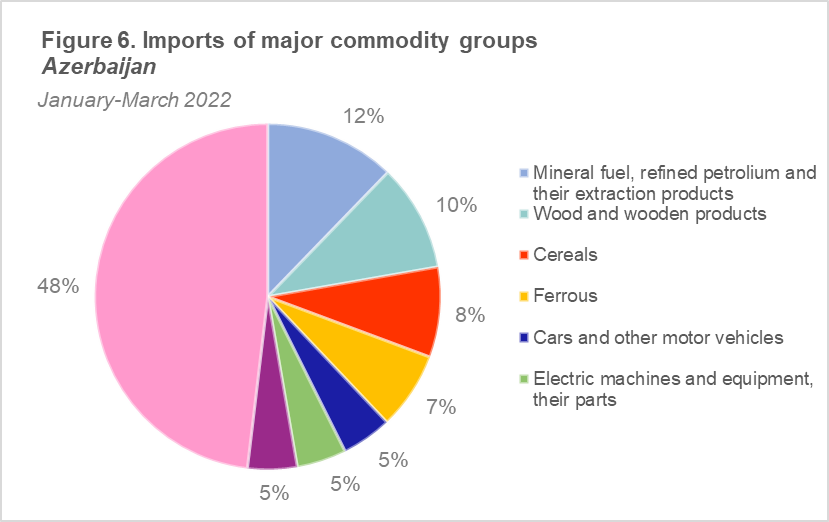

As the share of imports from Russia experienced a growth of 5% in the first quarter of 2022, mineral fuels, and refined petroleum products were the major products for the import value (USD 58 million). Secondly, wood and wooden products were among the most purchased products, which are used to build construction materials. Following that, imports of cereals amounted to USD 40 million, increasing in value due to rising food prices.

Data source: Azerbaijan State Customs Committee

Undoubtedly, Russia has been the main exporter of wheat to both Azerbaijan and Georgia for decades, however, it is a positive detail that in the first quarter of 2022, Azerbaijan managed to reduce the amount of imported wheat from Russia by 50% compared to the first quarter of last year. Thus, in the first three months of 2021, wheat imports from Russia accounted for 98% of all wheat imports for that period. Azerbaijan managed to eliminate this dependence to some extent, by developing economic relations with Kazakhstan.

To sum up, Azerbaijan is gradually decreasing its reliance on Russian goods, replacing them by other alternatives and opening to the world market. While strategies could be implemented to build a sustainable economic environment, it is still relatively hard to retreat from the Russian market at once, especially considering the monopolies it's been building around since the collapse of the Soviets.

Data source: Azerbaijan State Customs Committee, GeoStat

Foreign direct investment

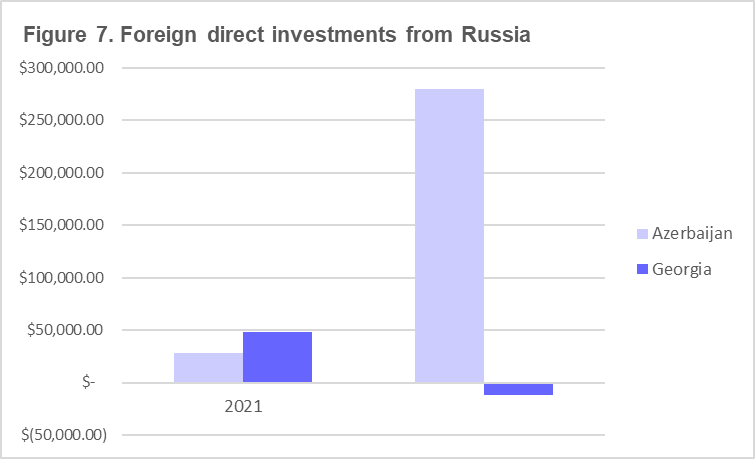

Although the bilateral relations between Georgia and Russia substantially deteriorated after the 2008 war, they moved forward with the Georgian Dream having come to power. Strengthening economic relations with Russia has also affected the investment market over the years, despite fluctuations in some terms.

Consequently, those fluctuations emerged from different setbacks, as well as the war, causing a negative FDI balance. In this scenario, a negative balance made an appearance again for the first time since the second quarter of 2017. To be more precise, in the first seven months of 2022, foreign direct investments from Russia hit a low point of USD -11.8 million. In this case, a negative FDI is caused by the exceeding value of outflows from Georgia to Russia of the inflows in the investment market.

On the other hand, in Azerbaijan, Russian investments skyrocketed in the first 7 months of 2022, soaring at USD 280 million. This could be the reflection of newly launched businesses by Russian investors and businessmen, mainly who fled the country.

Data source: The State Statistical Committee of the Republic of Azerbaijan, GeoStat

Remittances

Money transfers from abroad have always been one of the key indicators of a country's social-economic welfare, especially since most of its population is living abroad. Since Russia has been a big rich neighbor to post-soviet countries after their independence, people from those countries opted for a life and a workplace there. Despite the war and risks that the Russian currency has taken, remittances from Russia to both countries did not face a decline. On the contrary, in Azerbaijan, 80% of all money transfers were made from Russia in the first half of 2022, while this was only half of the total for the same period of 2021. In the case of Georgia, similarly, remittances went up by

As a result, the share of remittances in both countries grew in the first half of 2022.

The reflection of war on the Consumer Price Index

Consequently, surges in the prices of goods and services have a lot of side effects on the population, even though numbers show differently.

Conclusion

Overall, despite the predictions, sanctions on Russia did not have a catastrophic effect on Russian Azerbaijan and Russian Georgian trade balance. In Georgia, import levels boosted, remittances were the highest compared with previous years and exports also saw an increase during the analyzed period. A negative investment balance with Russia caused major setbacks in the business world, especially affecting entrepreneurs. On the other hand, Azerbaijan’s export shares slightly decreased over the first two quarters of 2022, while a rise was observed in import levels. At the same time, remittances and

Ultimately, a stronger emphasis on bilateral relations and policymaking is necessary for both countries to reduce

* In some cases, the latest data existing is for September 20, 2022.

This article is originally published on the website of Journalism Resource Center.

![]()

- REGIONS :

- Russia and CIS

png-1748065971.png)

jpg-1599133320.jpg)